Fixing intent signal selling: Moving from activity- to fit-based prioritization

The promise was simple: intent signals would revolutionize how we prioritize accounts and drive revenue. The reality? Most revenue teams are drowning in noise, chasing ghosts, and watching conversion rates flatline. It's time for a fundamental shift in how we think about account prioritization at scale, evolving from activity- to fit-based account prioritization.

Greg Perotto

The promise was simple: intent signals would revolutionize how we prioritize accounts and drive revenue. The reality? Most revenue teams are drowning in noise, chasing ghosts, and watching conversion rates flatline. For enterprise revenue orgs, time wasted on a bad deal can ruin a seller’s year and materially impact company ARR. It's time for a fundamental shift in how we think about account prioritization at scale, evolving from activity- to (much more effective) fit-based account prioritization.

The intent signal illusion

Walk into any revenue organization today, and you'll hear the same story from leadership to the front lines. Intent signals were supposed to be the holy grail—the magic bullet that would tell us exactly which accounts to pursue, when to pursue them, and how to win. Instead, they've become one of the most frustrating aspects of modern GTM strategy. The general commentary from sellers is both more colorful and more pessimistic.

The promise: Laser-focused account prioritization based on real buying “intent”.

The reality: A deluge of false positives, generic signals based on activity not fit, and accounts that appear “hot” but go cold the moment sellers attempt contact.

The view from the C-Suite: Revenue leaders speak out

Revenue leaders are feeling the pain acutely. They've invested heavily in intent data platforms, only to see their teams spinning their wheels on accounts that never convert with no path to achieving the promised improvements to deal cycles, sizes, and closed/won status.

Comments like "We get hundreds of intent signals per week" can be heard regularly at CRO meet ups. But they’re quickly followed by, "But when we dig deeper, most of these 'high-intent' accounts are early in their journey, doing their due diligence but planning to renew with a competitor, researching for academic purposes, or are otherwise false positives. Our reps are burning through leads, wasting time on deals that aren't real opportunities and it’s hurting our revenue goals and cost of sales."

The metrics tell the story: conversion rates from intent-driven outreach often hover in the single digits, and the time from signal to closed-won stretches far longer than traditional pipeline metrics suggest it should.

Revenue leaders are asking the hard questions:

- Why are we investing six figures plus annually in intent data that doesn't translate to pipeline or revenue?

- What's the actual ROI of our intent signal investments?

- How do we differentiate between activity and fit to get at genuine buying intent?

Drowning in data, starving for insights

Revenue operations leaders have perhaps the most frustrating view of the intent signal landscape. They're tasked with operationalizing these signals, creating scoring models, and ensuring sales teams focus on the right accounts—all while working with fundamentally flawed data inputs.

"Intent signals give us activity, not context," noted one seasoned RevOps leader in a recent call. "We can see that someone from Company X downloaded a whitepaper about our category, but we have no idea if they're the decision-maker, if they have budget, if there's an active project, or if they're just doing research for a board deck."

The operational challenges compound quickly:

- Signal fatigue: Teams become numb to alerts when most don't convert.

- Prioritization paralysis: Every account looks equally "hot" based on generic activity.

- Resource misallocation: Top sellers chase false signals while real opportunities go untapped.

- Attribution nightmares: Connecting intent signals to actual closed/won deals remains largely theoretical.

- Missed revenue targets: Time wasted chasing the wrong deals can materially impact revenue.

Fighting an uphill battle

Sales enablement leaders are caught in the middle, trying to train teams to effectively use intent signals while questioning the limitations of the data. They're creating playbooks for intent-based outreach that often feel generic and templated because the underlying signals themselves are generic, lacking the specificity needed for truly personalized engagement.

"We're teaching our reps to mention that a prospect downloaded a piece of content, say a research report or eBook, but that's not meaningful conversation," notes a VP of Sales Enablement. "It’s an ‘inside-out’ view that creates hollow personalization. Prospects see right through it, and it hurts our credibility because it isn’t focused on the customer, their priorities, or how we help, making us look like vendors selling commodities, not strategic partners offering solutions."

The challenge extends to coaching and performance management. How do you coach a rep who's diligently following up on intent signals but seeing poor conversion rates? How do you distinguish between issues with seller execution versus data quality?

The front lines: Sellers share their frustrations

Business Development Reps, Sales Development Reps, and Account Executives alike are living with the day-to-day reality of intent-driven prospecting and selling. And they're frustrated.

BDRs and SDRs report:

- High activity requirements based on intent signals that rarely convert to qualified meetings

- Difficulty crafting relevant outreach with generic signals that lack current customer state context

- Prospects who are confused or annoyed by outreach referencing their "intent" signals rather than that which speaks to their actual priorities and how their solution can solve them

Account Executives experience:

- Meetings from “intent-qualified leads” that don't match their Ideal Customer Profile (ICP) who are showing up simply to get the incentive offered to entice them to take the meeting

- Prospects in early research phases being passed on to AEs as "sales-ready"

- Difficulty building POVs, value propositions, and narratives around generic intent activities

"I got an intent alert that someone at a Fortune 500 company downloaded our ROI calculator," shared one AE. "When I finally connected with them, it was someone researching ideas for enhancing their own ROI tool."

The fundamental flaw: Activity ≠ intent ≠ fit

The core problem with traditional intent signals lies in a fundamental misunderstanding of what constitutes genuine buying intent. Current approaches conflate activity with intent and intent with fit, creating a cascade of false assumptions that undermine entire GTM motions.

- Activity signals tell us what someone did, not why they did it.

- Intent signals tell us someone might be interested, not whether we can solve their specific problems.

- Fit signals tell us whether our solution aligns with solving their unique priorities, needs, and challenges.

Most intent platforms stop at activity. Some attempt to infer intent. Almost none address fit—the most critical factor in determining whether an account represents a real opportunity for your specific solution.

A better path forward: ‘POV best fit’ analysis

At Poggio, we've been obsessing over this problem for a while. We've talked to thousands of revenue leaders, RevOps professionals, sales enablement leaders, sales managers, and sellers. We’ve studied what actually drives successful account prioritization. Our conclusion? The industry has been solving the wrong problem.

Instead of trying to predict when someone might buy something, GTM teams should be identifying accounts where their unique point of view (POV) will best resonate: That is, where their unique solution can best solve that individualcustomer’s specific priorities, needs, and/or challenges.

That requires a deep understanding of each customer, that’s continually updated and refined lest it become out of date with a change in the market, industry, customer, their priorities, your ICP, product, sales process, the competition, or any of the million other things that can change from day-to-day and materially affect your POV. But once you are able to focus in on the current customer state and build a POV on how you can help, that’s gold. It drives intelligent account prioritization, smart coverage modeling, informed territory planning, personalized outbound motions, what plays to run in deal cycles—even retention and growth motions with existing customers.

Custom account attributes: The new foundation of true fit

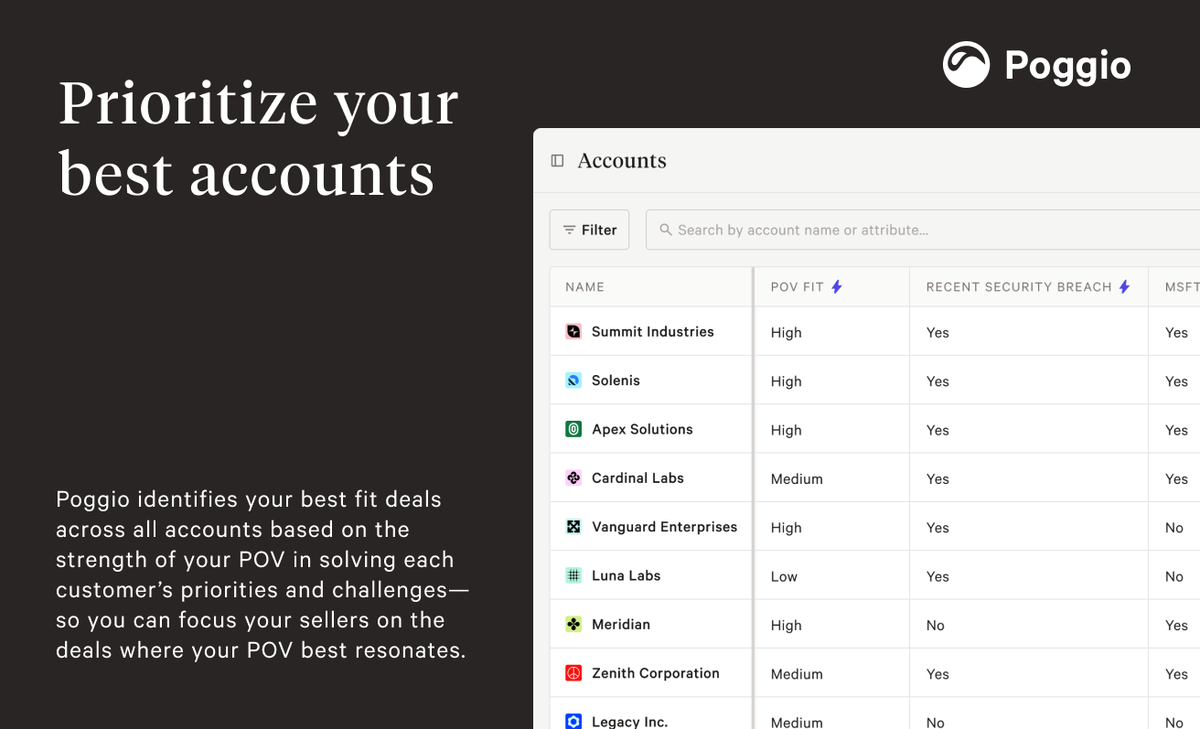

Poggio’s new custom account attributes goes beyond traditional firmographic and technographic data to understand the unique characteristics that make an account a perfect fit for your solution. We configure Poggio specific to your GTM motion, value framework, ICP, solution, competitive differentiators, and more to analyze the account attributes that combine to indicate actual fit between your prospect and your solution. It’s a 1:1 look that can then be stack ranked against all of your other accounts in order to prioritize opportunities across your TAM.

Poggio AI agents look at both first and third party sources, structured and unstructured data, historical ‘inside out’ views of your customer paired with forward-looking, ‘outside in’ intel to deliver deep account insights that drive action to deliver results.

For example, POV best fit custom account attributes for a leading enterprise security provider might include:

- Who is the executive buying decision maker and what are their business priorities, needs, and challenges?

- How well does our solution uniquely solve the prospect’s priorities, needs, and challenges?

- What is the prospect’s current tech stack?

- What are the prospect’s integration requirements?

- Has the prospect or one of their competitors had a recent data breach?

- Have there been any data privacy, security, or compliance regulatory changes that affect their business?

- Have they recently hired a new CISO?

This isn't about broad demographic categories—it's about understanding the specific attributes that correlate with your most successful customer outcomes. Poggio’s ‘POV best fit’ analysis takes account prioritization to the next level by identifying accounts where your unique point of view (POV) creates the strongest value proposition. Instead of chasing generic intent signals, you can focus on accounts where your POV will resonate the most:

- Your value proposition directly addresses their strategic priorities, needs, and challenges.

- Your solution approach aligns with their tech infrastructure and operational requirements.

- Your competitive positioning gives you the strongest advantage.

The result is better conversion, faster deal cycles, higher win rates, and bigger deal sizes.

The future of account prioritization must start now

The intent signal era isn't over, but it is evolving. Today the fundamental flaws of intent signals affect your GTM motion through your people and their ability to meaningfully connect with, engage, and grow your customers (and revenue).

But in the very near future, where AI agents are selling to and supporting your customers alongside your people, it has the potential to create the perfect storm of disadvantage, driving a broader and deeper layer of misalignment between you and your customers.

The future belongs to revenue organizations that can identify not just who might be in market for a solution, but where they have the best chance to win with their solution. This requires a fundamental shift in intent signal selling, from activity- to fit-based insights that drive intelligent account prioritization. It means investing in understanding your unique value proposition and systematically identifying the accounts where that value proposition creates your strongest competitive advantage.

What’s your intent?

Are you ready to move beyond activity-based intent signals to fit? If you're tired of chasing intent ghosts and ready to focus your team on accounts where you can actually win, we'd love to show you how Poggio’s custom attributes and ‘POV best fit’ analysis can transform your GTM strategy, execution, and results.

Get started with Poggio today.